Cut Manual Work + Approval Chaos With Finance Automation — Delivered in 5 Weeks

No tools to buy. No code to write. We build workflow automation that works on your existing stack.

Your Finance Operations are Drowning in Inefficiency

These daily struggles are crushing your team's potential

Massive Productivity Loss Every Day

Slow Approval Processes

Extended processing times

What's really happening:

Watch finance teams juggle between 5+ different systems, wait for email approvals, manually track request status in spreadsheets, and lose critical paperwork while urgent business decisions sit in limbo.

Manual Reconciliation

Hours of rework daily

Whats really happening:

Your team downloads data from QuickBooks, exports from Salesforce, pulls reports from banking platforms, then manually matches transactions in Excel while praying nothing gets missed or miscategorized.

Fragmented Reporting

Delayed audit preparation

What's really happening:

When executives need reports, your team scrambles across 6 different systems, manually compiles data into PowerPoint slides, double-checks calculations, and still worries the numbers don't tell the complete story.

Compliance Gaps

Regulatory Risk

What's really happening:

Watch finance teams juggle between 5+ different systems, wait for email approvals, manually track request status in spreadsheets, and lose critical paperwork while urgent business decisions sit in limbo.

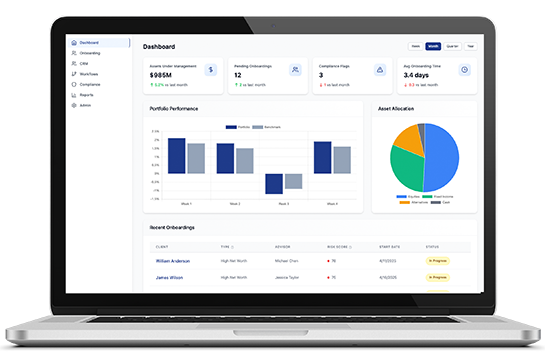

Nymbl Finance Automation: Built for Your Operations

Purpose-built automation that integrates with your existing systems and processes, delivered as a complete solution.

Approval Automation

Intelligent workflows

What's really happening:

Replace email chains and spreadsheet approvals with intelligent rule-based workflows. Requests route automatically based on amount, department, or custom criteria while maintaining complete audit trails and real-time status tracking.

Direct System Integration

Seamless connectivity

How it works:

Connect directly to Salesforce, QuickBooks, banking platforms, and internal databases. No manual exports or imports - data flows automatically between systems while maintaining data integrity and security standards.

Live Dashboards

Extended processing times

What's really happening:

Real-time dashboards pull data from all your systems automatically. Executives get live financial metrics, approval status, and audit-ready reports without waiting for manual compilation or Excel exports.

Audit Traceability

Risk mitigation

How it Works:

Every action, approval, and data change is automatically logged with timestamps, user attribution, and business context. When auditors need documentation, everything is instantly accessible with complete lineage.

How It Works

From assessment to full deployment, we handle every step of your ESG automation transformation.

Operations Assessment

Audit

Whats Included:

- System integration audit

- Workflow mapping & bottleneck analysis

- ROI calculation with specific metrics

- Custom automation roadmap

Expected Outcome:

- Current processing time: 6h 45m → Target: 2h 15m

- Projected savings: $180K annually

Automation Preview Session

Demo

What's Included:

- Interactive prototype of your workflows

- Real-time classification and routing simulation

- Integration preview with your current systems

- Exception handling and human-in-the-loop demo

How it works:

See automation handling your actual approval processes, connecting to your systems, and generating reports in real-time. Test edge cases and see exactly how decisions flow through the system.

5-Week Implementation Sprint

Sprint

What's Included:

- Complete system integrations

- Automated workflows deployment

- Human oversight dashboard and review queue

- Basic compliance reporting and audit trails

How it works:

We deliver working automation integrated with your existing systems. No disruption to current operations - automation layers on top of what you already have while maintaining full audit trails.

Automation Management

Support

What's Included:

- 24/7 monitoring and maintenance

- Performance optimization

- New workflow additions

- System integration updates

How it works:

Continuous management, scaling, and enhancement of your automation. As your business grows and changes, we ensure your workflows evolve to match your needs while maintaining reliability and compliance.

Empowering Your Financial Operations with Tailored Solutions

We're a transformation partner specializing in Financial compliance automation, AI agents, and strategic advisory services.

Revolutionize the way your business operates with custom-built digital solutions designed to address your unique challenges.

Tailored to You

From operational inefficiencies to system integrations, we craft solutions that adapt to your specific needs.

Scalable and Secure

Built to grow with your business while adhering to the highest security standards.

Seamless Integration

Easily integrate with your existing systems, ensuring smooth operations without disruptions.

Leverage the power of artificial intelligence to drive innovation and optimize performance.

AI-Powered Efficiency

Automate complex workflows, enhance decision-making, and reduce operational overhead.

Industry-Specific Expertise

Whether in financial services, healthcare, or manufacturing, our AI solutions are tailored to your industry.

Cutting-Edge Tools

From predictive analytics to natural language processing, we deliver AI solutions that keep you ahead of the curve.

Gain clarity and direction with strategic guidance from industry experts.

End-to-End Strategy

From concept to execution, we guide your enterprise through every stage of your digital transformation.

Tech-Agnostic Approach

Recommendations based on what works best for your unique needs, not a one-size-fits-all model.

Future-Proof Solutions

Stay ahead of the competition with advice grounded in scalability, security, and innovation.

.png)

.png)

.png)

.png)

Trusted by Teams Modernizing Ops In:

From Workarounds to Workflow

See what changes when you modernize your finance operations

Before: Now

Current State

- Approvals managed in Excel

- Manual reconciliation + rework

- Reporting slows audits

- Dev backlog blocks improvements

After (With Nymbl)

Transformed State

- Rule-based flows with audit trail

- Integrated systems with traceable data

- Live dashboards + clean exports

- Fast automation layered on existing stack

"It was like giving my ops team superpowers — and we didn't have to rebuild anything."

Proven Results

75

Cut manual

reconciliation time

8

Spreadsheets replaced

with internal tools

100

Full audit

trail maintained

5

Implementation

timeline

What You'll Get

Risk-Free Onboarding

Start with 2 completely free services. See the value before you invest.

1

Free Finance Ops Audit

- Map your current workflow

- Spot friction and risk points

- Identify automation opportunities

2

Free Live Demo

- Working prototype of your solution

- See exactly how it will work

- Test before you commit

3

30-Day Implementation

Working quote automation integrated with your systems.

4

Ongoing Optimization

Continuous improvement and scaling of your automation.

Risk Free Guarantee

Plus: $250 gift card if we don't show clear value in your audit *

* When you book and complete a demo call. To qualify, you must attend the demo and share feedback on why it didn’t deliver value for your organization. One gift card per company.